Introduction:-

Environmental, social, and governance (ESG) investing is a rapidly growing trend in the world of finance. It’s an investment approach that prioritizes companies that are committed to making a positive impact on the world, while avoiding those that are not. In this guide, we’ll delve deeper into the world of ESG investing, why it matters, and how you can get started.

What is ESG Investing?

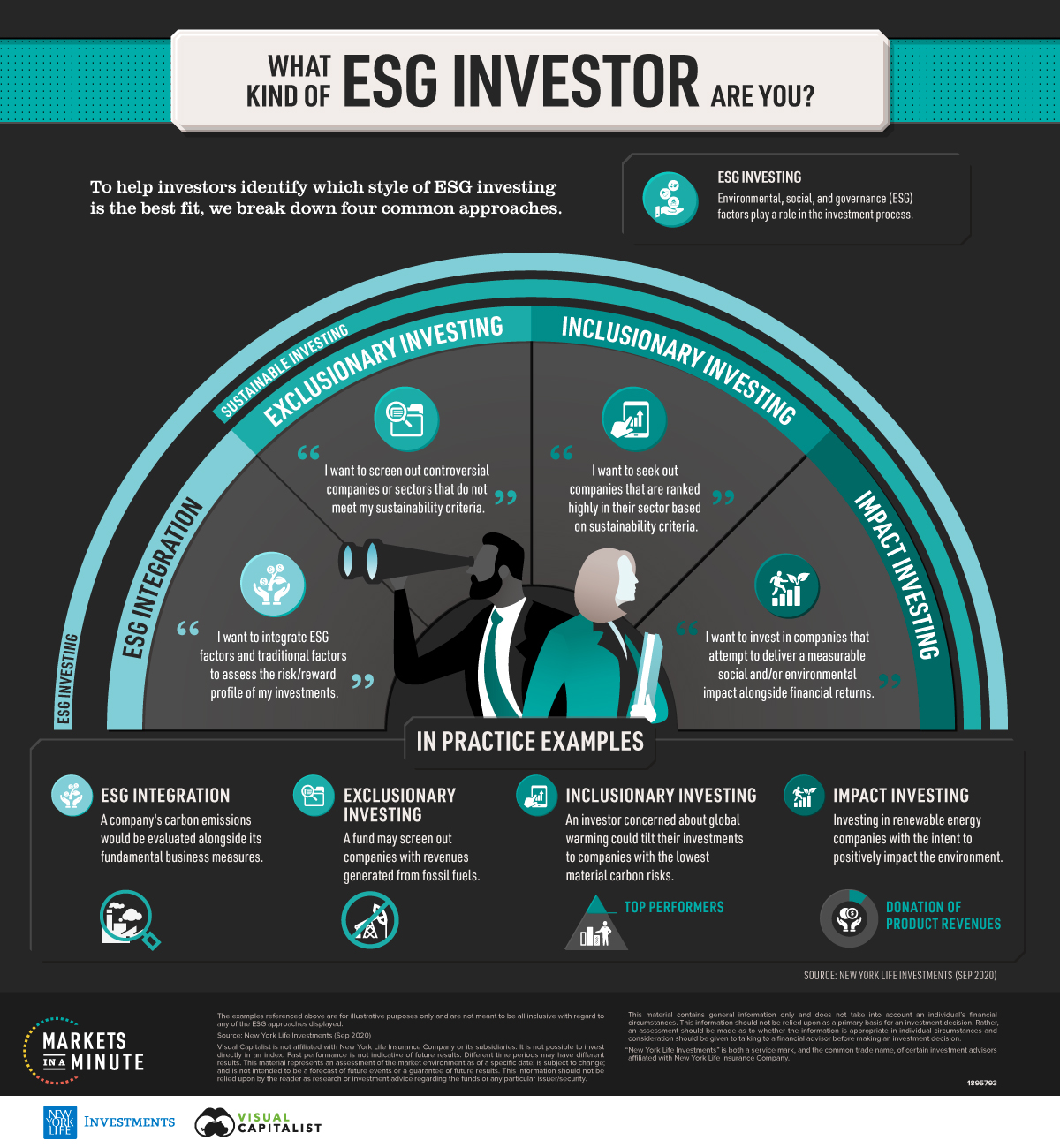

ESG investing is an investment strategy that seeks to combine financial returns with positive social and environmental outcomes. This investment approach takes into account a company’s performance on environmental, social, and governance factors when making investment decisions.

There are various ways to integrate ESG into the investment process, such as:

- Screening: This involves excluding companies that don’t meet certain ESG criteria, such as those that have a history of pollution, unethical business practices, or poor labor standards.

- Integration: This involves incorporating ESG factors into traditional financial analysis when selecting investments.

- Active ownership: This involves engaging with companies to encourage them to improve their ESG performance, such as by using shareholder votes or advocating for policy changes.

Why Does ESG Investing Matter?

There are several reasons why ESG investing matters:

Positive Impact: By investing in companies that prioritize ESG issues, investors can help promote positive social and environmental outcomes, such as reducing carbon emissions, promoting gender and racial diversity, and supporting human rights.

Risk Management: Companies that have poor ESG performance are often exposed to a range of risks, including reputational damage, legal liabilities, and regulatory scrutiny. By avoiding these companies, investors can potentially reduce their exposure to these risks.

Long-Term Performance: Companies that prioritize ESG issues may be better positioned to succeed over the long-term, as they are more likely to be sustainable and resilient in the face of environmental and social challenges.

How to Get Started with ESG Investing:-

Learn the basics: Before making any investment decisions, it’s important to understand the basics of ESG investing. You can start by reading articles, watching videos, and attending webinars that cover the topic.

Determine your values: ESG investing is all about aligning your investments with your values. Think about what issues are most important to you, such as climate change, social justice, or good governance, and use that to guide your investment decisions.

Research ESG funds: There are a growing number of ESG funds available, ranging from mutual funds to exchange-traded funds (ETFs). Research these funds to determine which ones align best with your values and investment goals.

Evaluate ESG factors: When evaluating ESG funds, look for information on how they integrate ESG factors into their investment decisions. This could include details on their screening criteria, engagement strategies, and voting practices.

Monitor your investments: Once you have invested in an ESG fund, it’s important to monitor its performance and ESG ratings. This can help you stay informed about any changes in the fund’s ESG approach, and make adjustments to your portfolio as needed.

ESG Investing Strategies:-

There are various ESG investing strategies, such as:

Thematic Investing: This involves investing in companies that are aligned with a specific theme, such as renewable energy, healthcare innovation, or sustainable agriculture.

Best-in-Class Investing: This involves investing in companies that rank highly in their industry on ESG factors, compared to their peers.

Impact Investing: This involves investing in companies or funds that aim to generate positive social or environmental outcomes, in addition to financial returns.

Engagement Investing: This involves investing in companies and using shareholder votes or advocacy to encourage them to improve their ESG performance

Wowo

ReplyDelete